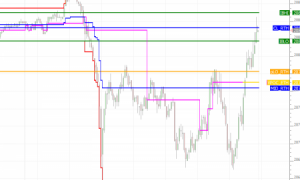

FlexLevels® (RTX)

The FlexLevels® Indicator facilitates the sharing of key price levels for one or more instruments among a group of Investor/RT users. An educator or trading room mentor or an individual trader first creates a chart with the instrument(s) and the desired reference lines he wishes to share. Using File > Functions > Export FlexLevels, the price levels are exported to a compact text file (a .csv file). The exported file contains all of the information about each line/level including: price, label, color, width, position details, and band details, if applicable.