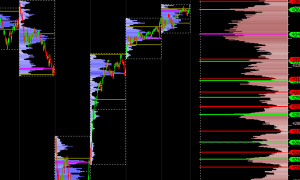

TPO Indicator (TPO)

The TPO Indicator computes and displays historical values for TPO Profile price levels: POC, Value Area High (VAH), Value Area Low (VAH), developing POC, VAH, and VAL. It enables review these values historically to see see how price reacted when approaching these levels. While developing POC, VAH, and VAL change throughout the day, traditional TPO Profile charts only show the current values. The TPO Indicator allows the user to look back and see where the levels were at any given historical time. TPO is an acronym for Time/Price Opportunity.