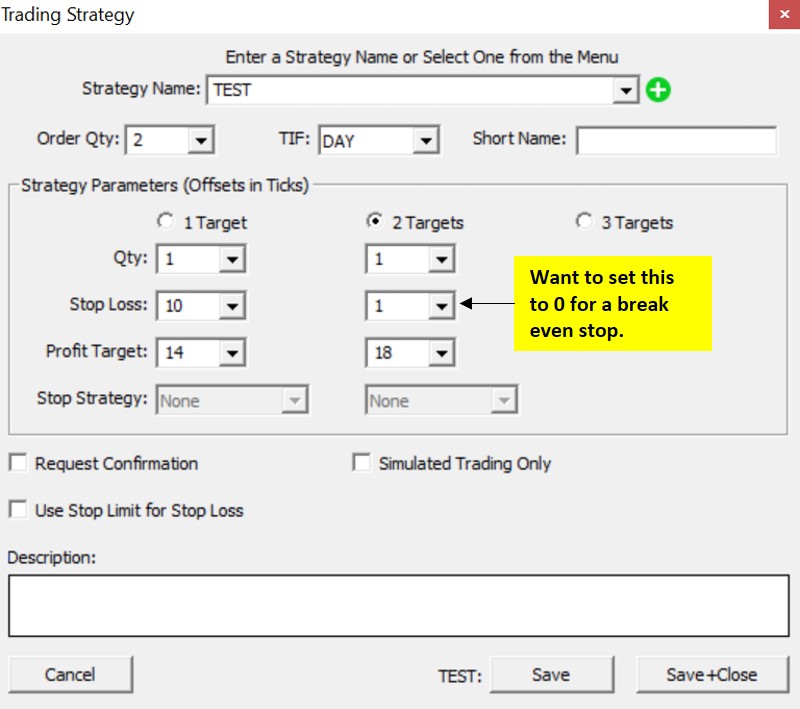

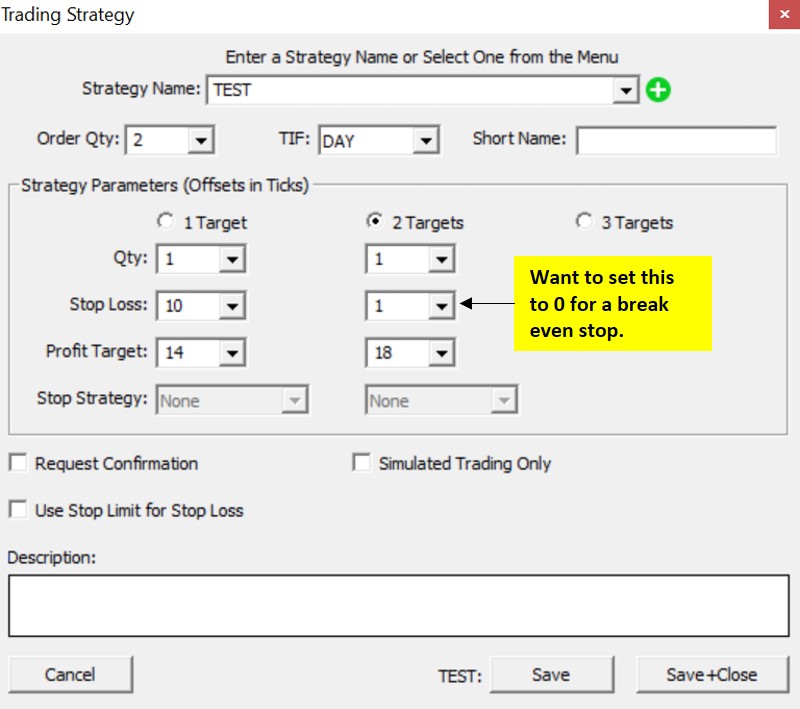

In a trading strategy that has one scale out and one final target, how can the stop loss setting on the final target be set to break even or higher? The options do not seem to allow setting the stop loss less than 1 tick.

Thank you.

In a trading strategy that has one scale out and one final target, how can the stop loss setting on the final target be set to break even or higher? The options do not seem to allow setting the stop loss less than 1 tick.

Thank you.

At the present time, Investor/RT has limited support for server side trading order automation. Trading Strategies are presently available for server side automation for Investor/RT clients who use either CQG or Rithmic order routing. Each trading strategy setup has offsets for stop loss and targets, up to three target OCO pairs can be submitted to the broker for server side automation of the trade. Each target also has what we call a "Stop Strategy", which as you see in the user interface is disabled presently since Stop Strategy is not yet implemented. When you enter a trade, you see the stop and target working orders in the Chart Trading DOM. If the market moves in your favor, you can manually slide the Stop Loss working order(s) to your break even (fill) price at your discretion. At some future time, we plan to implement and enable the Stop Strategy user interface. This will be a separate setup where you can specify, for example, a break even stop or a trailing stop strategy setup. When this is implemented in a future version of Investor/RT the entire strategy will be sent to the broker as one bundle of OSO/OCO orders that will automate the order management on the server side.

Until then, you can manually adjust stops to either trail or rest at a breakeven point for the trade. Alternatively, you could use a signal marker or a trading rule indicator to automate or semi-automate the adjustment of stops using an RTL signal. The Investor/RT RTL language has various TR_ tokens the enable a signal to detect when you are long or short, the position size, whether there are working orders active and the prices of those working orders. For example, an RTL signal can be written to fire (value as true) whenever you are long and have a sell stop working order active, and the number of ticks of gain/loss (+/-) that you have in the position is profitable by at least some number of tick increments. When this signal fires true (via a signal action), the signal action can evaluate a confirming RTL expression which if true, results in a trading order being submitted to the broker to revise the stop price so that the stop rests some number of ticks below the last trade price. See the support article titled Trading Related Tokens on linnsoft.com for more details:

https://www.linnsoft.com/feature/trading-related-tokens.

Using RTL to monitor and manage trading orders requires expertise in the RTL language and proper testing with the trading simulator before deployment under a live trading account. Search linnsoft.com for "RTL 101" for a series of articles explaining the basics of the RTL Language. Search for Signal Action or Trading Rule Indicator to learn more about how these setups can be harnessed to monitor and perform client side order management operations. The need for this kind of RTL programming will be eliminated in whole or in part when Stop Strategy setups become available, later this year we hope.