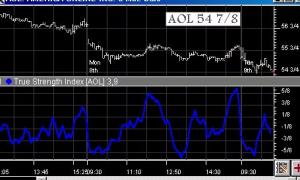

True Strength Index (TSI)

True Strength is a variation of the Relative Strength indicator. It uses a double smoothed exponential moving average of price momentum to eliminate choppy price changes and spot trend changes. This indicator has little or no time lag. An increasing True Strength value indicates increasing momentum in the direction of price movement.