Howdy Guys -- I am having a hard time wrapping my head around RTL and setting up a backtest for what I'd think would be a simple use case (perhaps not).

Essentially, I want to backtest entries taken long or short on the confluence between 2 leg pullbacks and fib ratios. Ideally, I am looking to optimize a number of different periodicities to find the most profitable for observed volatility.

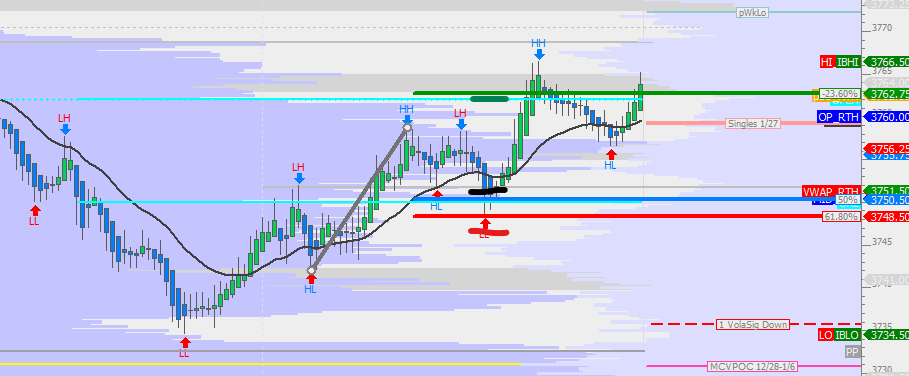

2 legged pullback entry example when the trend is positive would be the sequence of HH, HL, LH, LL as per fractals,

Fib entry would be X ticks above the 50% on the fib retrace as measured from the previous swing extremes.

Screenshot attached; entry black line, stop loss red line, profit target green line.

I really appreciate any help you can provide!