Investor/RT introduces an important new data handling option titled Consolidated Tape in version 13.2 for all users of the DTN IQFeed data services. The Consolidated Tape option not only provides users the ability to see the tape in a clean, compact, and organized fashion, but also has a variety of very important efficiency and performance advantages.

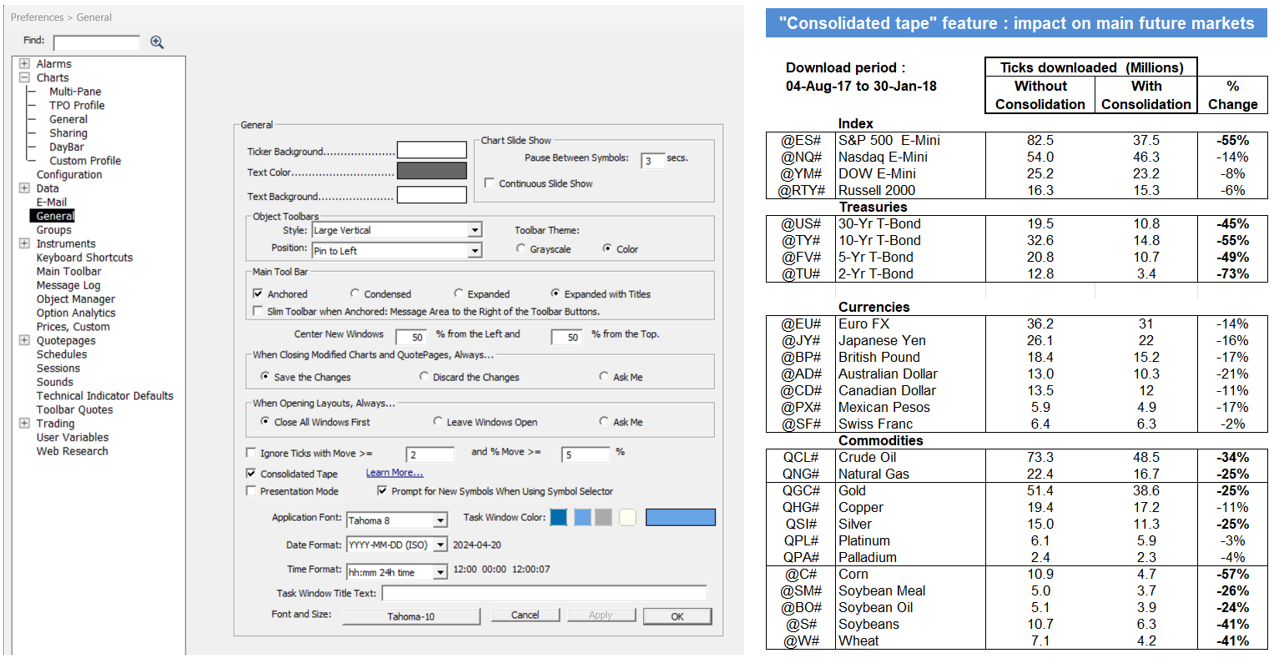

For DTN IQfeed subscribers, this feature is activated by checking the corresponding option in File > Preference > General (see screenshot below)

For DTN MA users with Rithmic as datafeed, please refer to the notice at the end of this page

In a nutshell, Consolidated Tape takes large trades that have been broken apart (by the exchange order matching algorithm) and reconstructs them as they flow into Investor/RT. The presence of the Tick ID provided by DTN on each trade allows this reconstruction for users of DTN IQFeed.

Using a specific example, a trader may want to buy 88 contracts of ES, yet, there is no single buyer willing to sell that many contracts at that price. The bid is instead filled by 45 different sellers with small sizes varying from 1 to 3 lots. By default, this transaction flows from the data service into Investor/RT as 45 small trades. Many traders however are more interested in the fact that there was a single player on one side of this transaction. Consolidated Tape puts these 45 trades back together the instant they flow into Investor/RT and passes them along to charts as a single large trade. These broken trades all burst in at the same instant with the same bid, ask, and trade price (with varying sizes). This gives traders a more accurate picture of what big and small traders are doing throughout the many Investor/RT features that take advantage of volume size filtering (VolumeScope®, Volume Breakdown, Profile Indicator, Price and Bar Statistics, and much more) as highlighted in this video :

https://www.linnsoft.com/videos/volume-filter

Consolidated Tape also provides another tremendous advantage in performance. Over the course of any given second, 3 consolidated trades may hit each chart instead of 150 raw trades. Over the course of a week, 490k trades may hit each chart instead of 1.5 million trades. Several InvestorRT indicators are calculated on a tick-by-tick basis : reducing the number of ticks to be processed will naturally result in a lighter CPU load and faster processing. Similarly, the initial loading time of charts will be significantly reduced.

When Consolidated Tape is turned on, backfill data will also be reconstructed. The table above provides the impact of this tick consolidation process over a 6 month period. The reduction in the number of ticks depends on each market characteristic, with S&P, Treasuries, and more generally commodities, benefiting the most, performance-wise, from this new consolidation feature (that will help also reduce the size of the tick database being managed by IRT). Please note that the tick reduction will be typically more important during regular trading hours (vs the overnight session) and even more during market activity spikes (such as during economic news releases or the final minutes of the market cash session).

Important notice for subscribers using Rithmic as primary data feed and the DTN MA service (for historical data backfill)

On a limited number of servers (usually named "MPD 3.0 summary"), Rithmic is providing the same consolidated tick data as the one obtained using DTN IQ feed together with InvestorRT "consolidated tape" option. Connecting to such Rithmic servers brings the same trade analysis (ie identifying large player activity) and performance benefits as the one previously explained for DTN IQ feed subscribers.

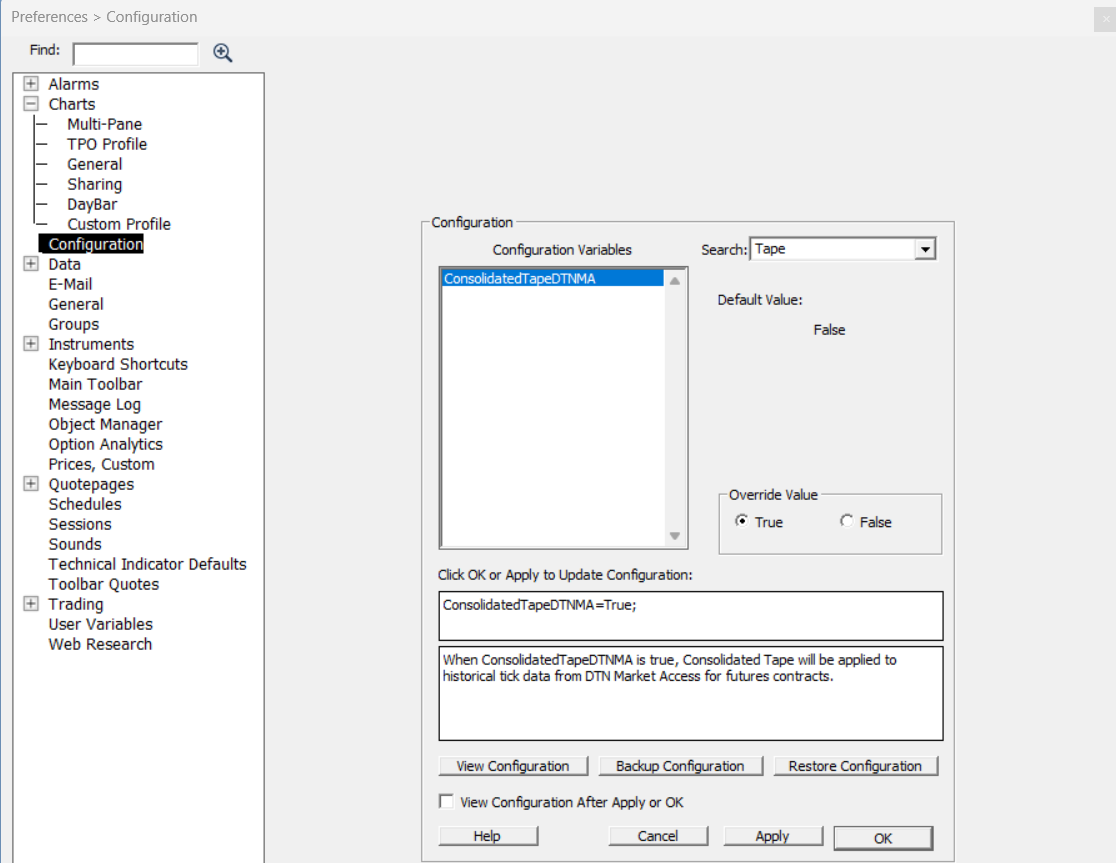

In that case, to have "consistent" consolidated tick data backfill from DTN MA, one needs to set the global configuration variable "ConsolidatedTapeDTNMA" to true.

Additional information :

Volume Filter Chart (used in the video) : https://www.linnsoft.com/charts/volumefilter-es

Rithmic connexion setup guide : https://www.linnsoft.com/support/rithmic-market-data-and-order-routing

CME MDP 3.0 data : https://www.cmegroup.com/confluence/display/EPICSANDBOX/CME+MDP+3.0+Mark...