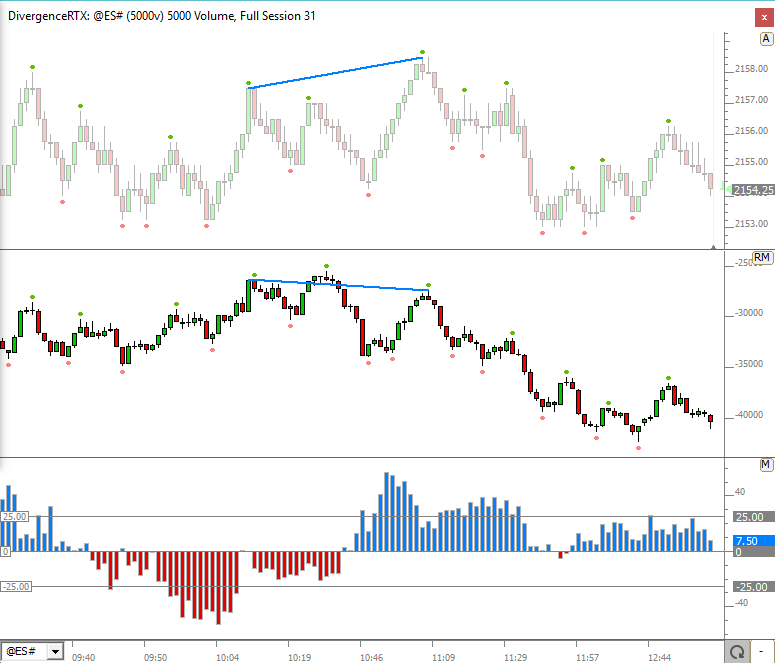

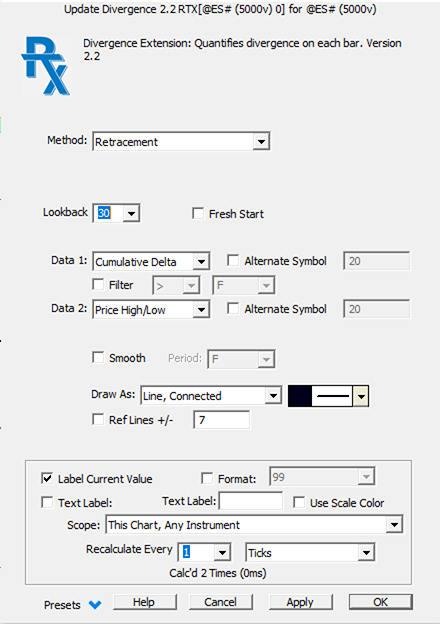

The Divergence RTX indicator quantifies divergence with a numerical value between two data series using various methods. Each data series may consistent of either price data, cumulative delta filtered, filtered cumulative delta, or any other indicator available in Investor/RT. Also, each data source may be built off the data of the charted symbol or any alternative symbol. With these options, users may measure divergence between Price and Cumulative Data, Price and ANY Indicator, Price of one symbol vs Price of any other symbol, Indicator value one symbol vs Indicator value of another symbol, Cum Delta of one symbol vs Cum Delta of another symbol, etc. And the Cumulative Delta can be filtered by size (only trades above 10 lots, only trades below 15 lots, etc). In measuring divergence, we seek to identify strength in one data series relative to another data series at any given time. The indicator provides a variety of methods for computing divergence: Retracement, Percent Change, High to High, and Low to Low. A Minimum and Maximum Lookback period allow the user to control the series or window of past bars which will be compared to each bar in the divergence calculation. A Fresh Start option prevents divergence from looking back into the prior session.

Presentation