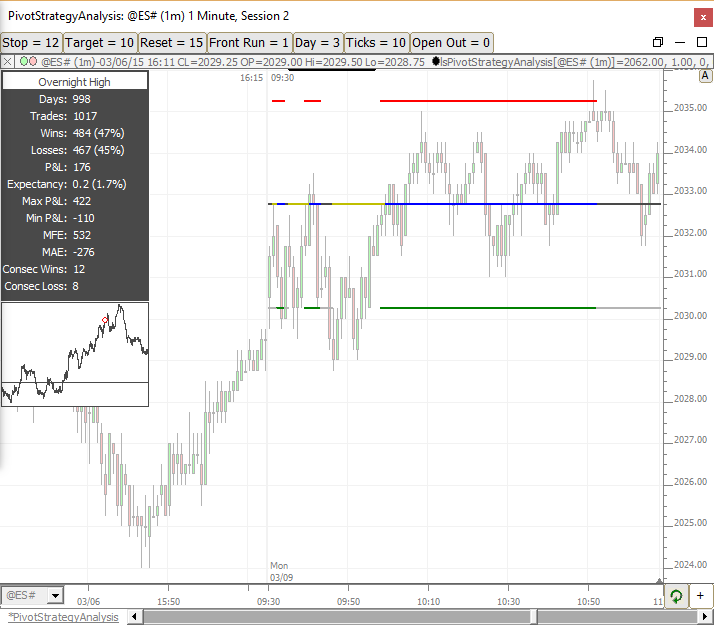

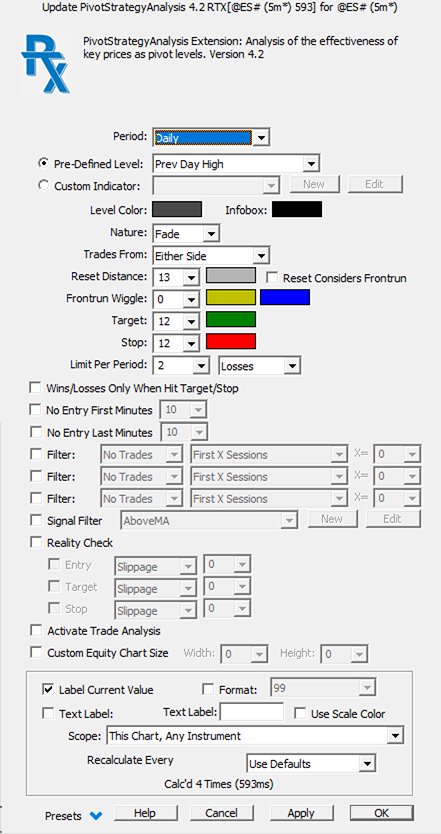

The PivotStrategyAnalysis (PSA) RTX Extension allows the user to specify any key daily or weekly price level such as previous high, previous close, or overnight VPOC, and analyze the effectiveness of that level as a pivot point during the following session or week. The indicator provides for a variety of convenient options including stop, target, frontrun wiggle, reset distance, nature of system, trade limits, and time filters. The frontrun wiggle determines how far ahead of the level, if any, to enter the trade (defaults to 0). The reset distance dictates how far price must move away from the level, after a trade, in order for a new trade to be considered. The nature of the system may be set to either fade or trend. The number of trades per period may be limited to any number of trades, any number of losses, or any number of wins. Lines are automatically drawn which clearly mark the entry price, the reset price, target, and stop. An information box is provided which accumulates the trade information and reports total number of trades, number and percent of winners, number and percent of losers, net P&L, Max P&L, Min P&L, MFE, MAE, Consecutive Wins, and Consecutive Losses. The system may be set to either a daily or weekly period. Optional filters will prevent trading during a user specified number of minutes at the start and end of the session or week.

Note

The pre-defined levels for POC/VAH/VAL within PSA are limited to how far back you have tick data. These custom indicators allow you to go back as far as you wish studying these levels. Import the below chart in order to use PSA_POC, PSA_VAH, or PSA_VAL within Pivot Strategy Analysis.

Glossary of Terms:

- P&L - Profilt and Loss

- MFE - Maximum Favorable Excursion

- MAE - Maximum Adverse Excursion

- VPOC - Volume Point of Control

Presentation