Pivot Strategy Optimizer (RTX)

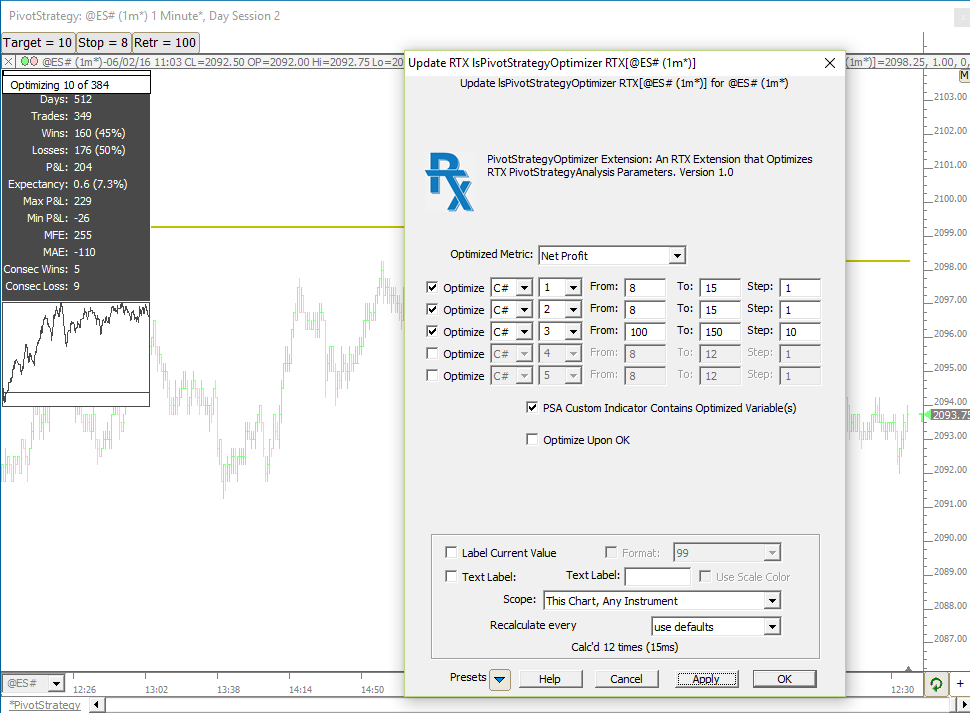

The PivotStrategyOptimizer (PSO) builds upon the PivotStrategyAnalysis (PSA) indicator to create an extremely powerful combination. PSO enables the optimization of any combination of a number of variables within PSA, allowing the user to quickly determine the optimal combination of values which would have resulted in maximized profits. PSO can optimize the target, stop, reset distance, frontrun wiggle, allowable trading hours, number of allowable trades/day, or an infinite array of other variables within the custom indicator upon which the PSA is based.

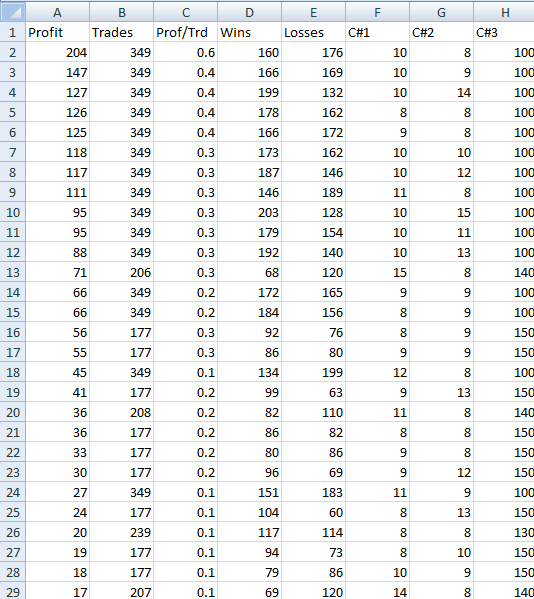

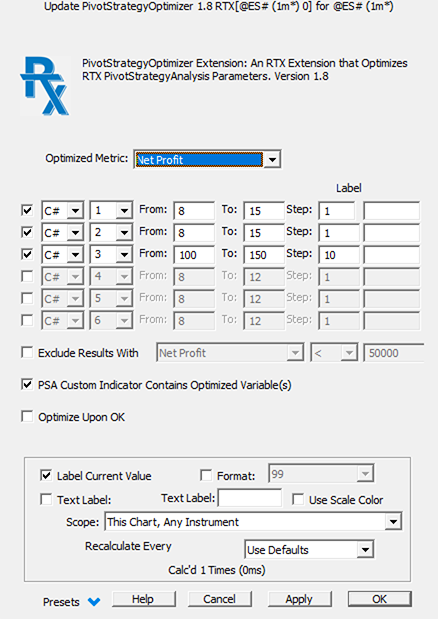

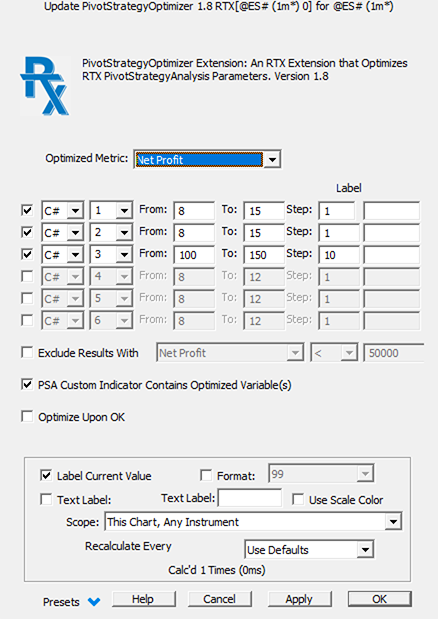

- Optimized Metric - Option to optimized based on Net Profit or Average Profile Per Trade. The optimized metric will dictate the what will be used when sorting the results. If Net Profit is chosen, the resulting spreadsheet will be sorted by net profit with the greatest net profit at the top.

- Optimize - Up to 5 variables may be optimized during each run. Both C# and V# variables may be optimized. User specifies a starting value, and ending value, and a step for each variable.

- PSA Custom Indicator Contains Optimized Variables(s) - Check this checkbox if the underlying PSA indicator is based on a Custom Indicator, and in turn that Custom Indicator contains variables which are to be optimized. Checking this box will force the custom indicator to be recalculated between each iteration and thus will slow down the optimization to some extent so only check this box if you are optimizing a variable with your custom indicator.

- Optimize Upon OK - When checked, a click upon the Apply or OK button will initiate the optimization process at which point a progress report will appear within the upper left corner of chart. When the optimization is complete, a spreadsheet will be presented with the results sorted by the optimized metric.

|

PivotStrategyOptimizer. This chart was uploaded by Investor/RT 12.6.1 showing symbol: @ES#. Read more Download

|

|

Pop-up Video |

Description |

View |

|

In this video, Homework #26, we explore the effectiveness of key daily price levels and study... |

Watch |

|

The PivotStrategyOptimizer (PSO) builds upon the PivotStrategyAnalysis PSA) indicator to create... |

Watch |

|

|

RTL is the Investor/RT Language, a formula language for composing trading signals, custom indicators, and scans. RTL is an end user language, designed to be used by those with little or no programming skills. RTL is used to write a formula. A formula may be a true/false condition, e.g. CLOSE < MA, that determines whether some condition is true or not for each bar (a signal) or the last bar (a scan). A formula may compute an arithmetic result, called a custom indicator. For example: MA ( HIGH - CLOSE ) computes a moving average of how far an instrument closes from its high. As you can see, RTL is more expressive, simpler, and easier to use than other market data languagues. Read more

|